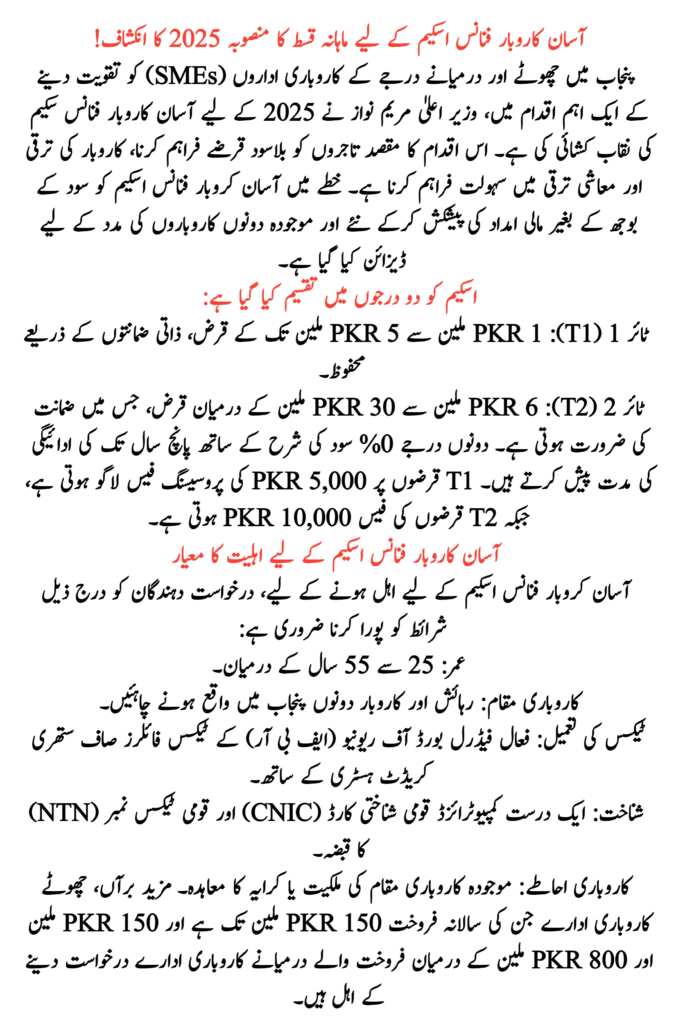

In a significant move to bolster small and medium-sized enterprises (SMEs) in Punjab, Chief Minister Maryam Nawaz has unveiled the Asaan Karobaar Finance Scheme for 2025. This initiative aims to provide interest-free loans to entrepreneurs, facilitating business growth and economic development in the region.

Table of Contents

The Asaan Karobaar Finance Scheme is designed to support both new and existing businesses by offering financial assistance without the burden of interest. The scheme is structured into two tiers:

- Tier 1 (T1): Loans ranging from PKR 1 million to PKR 5 million, secured through personal guarantees.

- Tier 2 (T2): Loans between PKR 6 million and PKR 30 million, requiring collateral.

Both tiers offer a repayment period of up to five years with a 0% interest rate. A processing fee of PKR 5,000 applies to T1 loans, while T2 loans incur a fee of PKR 10,000.

Read More: Status in Asaan Karobar Finance Scheme

Eligibility Criteria for the Asaan Karobaar Finance Scheme

To qualify for the Asaan Karobaar Finance Scheme, applicants must meet the following conditions:

- Age: Between 25 and 55 years.

- Business Location: Both residence and business must be situated in Punjab.

- Tax Compliance: Active Federal Board of Revenue (FBR) tax filers with a clean credit history.

- Identification: Possession of a valid Computerized National Identity Card (CNIC) and National Tax Number (NTN).

- Business Premises: Ownership or rental agreement of the existing business location.

- Additionally, small enterprises with annual sales up to PKR 150 million and medium enterprises with sales between PKR 150 million and PKR 800 million are eligible to apply.

Read More: Apply for the CM Punjab Asaan Karobar Finance Scheme

Asaan Karobaar Finance Loan Details and Repayment Terms

The scheme offers flexible terms to accommodate various business needs:

- Grace Period: Up to 6 months for startups and up to 3 months for existing businesses.

- Equity Contribution:

- T1 Loans: No equity contribution required, except for leased commercial vehicles.

- T2 Loans: 20% equity contribution, reduced to 10% for women, transgender individuals, and differently-abled persons.

- Repayment: Equal monthly installments over the approved term.

- Late Charges: PKR 1 per 1,000 per day on overdue amounts.

- Additional costs, such as insurance, legal, and registration fees, are applicable based on actual expenses.

Read More: Asaan Karobar Finance Loan Amounts

Monthly Installment Plan for Asaan Karobaar Finance Scheme

The monthly installment amount depends on the loan size and the chosen repayment period. Below is a table illustrating sample installment plans for different loan amounts over a 5-year term:

| Loan Amount (PKR) | Monthly Installment (PKR) |

| 1,000,000 | 16,667 |

| 5,000,000 | 83,333 |

| 10,000,000 | 166,667 |

| 20,000,000 | 333,333 |

| 30,000,000 | 500,000 |

Application Process for the Asaan Karobaar Finance Scheme

- Visit the Official Portal: Go to the official website for the Asaan Karobaar Finance Scheme.

- Register Online: Sign up by entering your CNIC, mobile number, and basic details.

- Upload Documents: Provide scanned copies of your CNIC, NTN, business ownership/rental agreement, and tax records.

- Select Loan Type: Choose the loan tier (T1 or T2) and specify the required amount.

- Pay Processing Fee: Submit the non-refundable processing fee online (PKR 5,000 or PKR 10,000 based on loan tier).

- Verification: Wait for digital and physical verification of your credentials and business premises.

- Approval & Disbursement: If approved, the loan will be disbursed directly to your provided bank account.

Read More: Asaan Karobar Finance Scheme: Common Reasons

Conclusion

The Asaan Karobaar Finance Scheme 2025 represents a significant opportunity for SMEs in Punjab to access interest-free financing, fostering entrepreneurship and economic growth. By providing flexible repayment options and comprehensive support, the scheme aims to empower businesses to achieve their full potential.

Read More: Asaan Karobar Finance Loan Processing