The Government of Punjab has recently launched the CM Punjab Asaan Karobar Finance Scheme, a groundbreaking initiative aimed at empowering small and medium-sized enterprises (SMEs) across the province. This scheme offers interest-free loans to support entrepreneurs in establishing and expanding their businesses. If you’re considering applying, it’s crucial to be aware of the application deadlines and the benefits this scheme provides.

Read More: Asaan Karobar Finance Loan Processing

Table of Contents

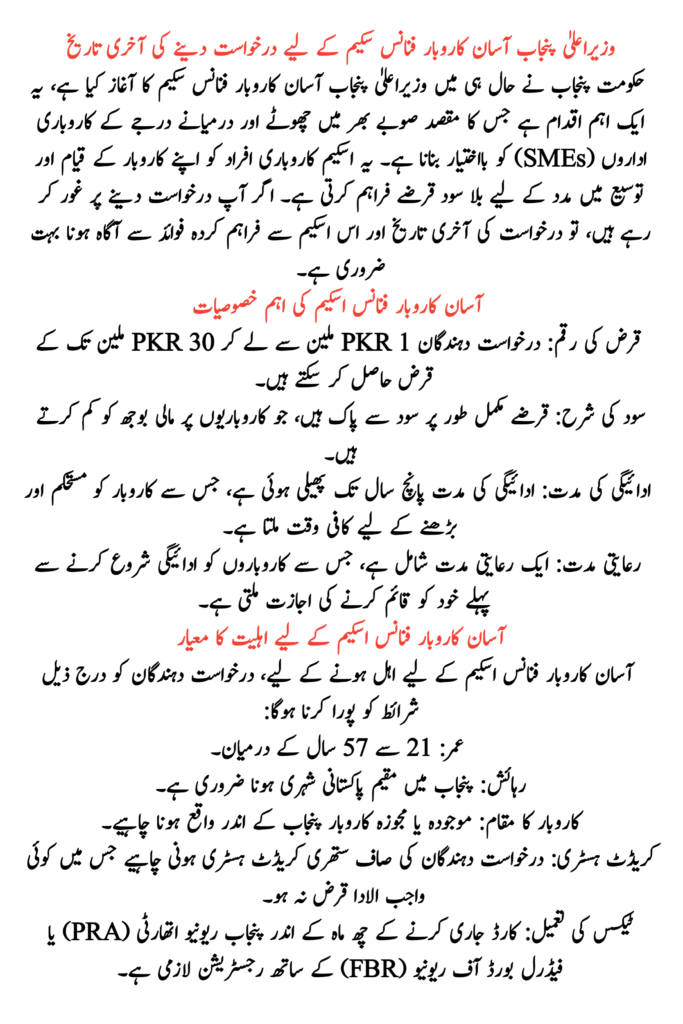

Overview of the Asaan Karobar Finance Scheme

The Asaan Karobar Finance Scheme is designed to facilitate SMEs by providing financial assistance without the burden of interest. The loans range from PKR 1 million to PKR 30 million, with a repayment tenure of up to five years, including a grace period. The scheme is implemented through the Bank of Punjab, ensuring a streamlined and transparent process for applicants.

| Feature | Details |

| Scheme Name | CM Punjab Asaan Karobar Finance Scheme |

| Loan Amount | PKR 1 million to PKR 30 million |

| Interest Rate | Interest-free |

| Repayment Tenure | Up to 5 years |

| Grace Period | Available |

| Eligibility Age | 21 to 57 years |

| Application Deadline | No fixed deadline; apply promptly |

| Processing Fee | PKR 5,000 for loans up to PKR 5 million, PKR 10,000 for higher amounts |

| Required Documents | CNIC, business details, tax documents, property documents |

| Helpline | 1786 |

| Official Website | Asaan Karobar Finance Scheme |

Key Features of the Asaan Karobar Finance Scheme

- Loan Amount: Applicants can avail loans starting from PKR 1 million up to PKR 30 million.

- Interest Rate: The loans are entirely interest-free, reducing the financial burden on entrepreneurs.

- Repayment Tenure: The repayment period extends up to five years, providing ample time for businesses to stabilize and grow.

- Grace Period: A grace period is included, allowing businesses to establish themselves before commencing repayments.

Read More: Eligibility for the Asaan Karobar Finance Scheme

Eligibility Criteria for the Asaan Karobar Finance Scheme

To qualify for the Asaan Karobar Finance Scheme, applicants must meet the following conditions:

- Age: Between 21 to 57 years.

- Residency: Must be a Pakistani national residing in Punjab.

- Business Location: The existing or proposed business should be located within Punjab.

- Credit History: Applicants should have a clean credit history with no overdue loans.

- Tax Compliance: Registration with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) is mandatory within six months of card issuance.

Read More: 1-30 Million Under Asaan Karobar Finance

Apply for the CM Punjab Asaan Karobar Finance Scheme

Interested individuals can apply through the following steps:

- Registration: Create an account on the Punjab Information Technology Board (PITB) portal using your CNIC-linked mobile number.

- Application Form: Complete the online application form, which takes approximately 15 minutes.

- Processing Fee: Submit a non-refundable processing fee of PKR 5,000 for loans between PKR 1 million to PKR 5 million, and PKR 10,000 for loans above PKR 5 million.

- Document Submission: Upload the required documents, including CNIC, passport-sized photograph, proof of tax filing, business income and expense details, and property documents.

- Submission: After completing all steps, submit the application and await further instructions.

Conclusion

The CM Punjab Asaan Karobar Finance Scheme presents a remarkable opportunity for entrepreneurs in Punjab to access interest-free financial support, fostering economic growth and business development in the region. Eligible individuals are encouraged to apply as soon as possible to take full advantage of this initiative.