The Asaan Karobar Finance Loan Scheme 2025 is a revolutionary initiative by the Punjab Government aimed at empowering small and medium businesses (SMEs) with interest-free loans. This program facilitates entrepreneurs to expand their businesses, create job opportunities, and contribute to the province’s economic development. Managed through the official portal akf.punjab.gov.pk, the scheme offers seamless online registration and loan management processes, making it highly accessible for aspiring entrepreneurs.

Table of Contents

Features of the Asaan Karobar Finance Scheme

The Asaan Karobar Finance Scheme provides financial assistance with easy terms to support various business needs.

- Loan Amount: Ranges from PKR 1 million to PKR 30 million.

- Interest-Free Loans: 0% interest rate to reduce financial burden.

- Repayment Period: Up to 5 years with structured monthly installments.

- Eligibility: Open to businesses that qualify as SMEs, ensuring targeted support for deserving entrepreneurs.

This initiative ensures transparency and ease of access, helping businesses overcome financial challenges and achieve sustainable growth.

| Key Details | Description |

|---|---|

| Loan Amount | PKR 1 million to PKR 30 million |

| Interest Rate | 0% |

| Repayment Period | Up to 5 years |

| Application Mode | Online via akf.punjab.gov.pk |

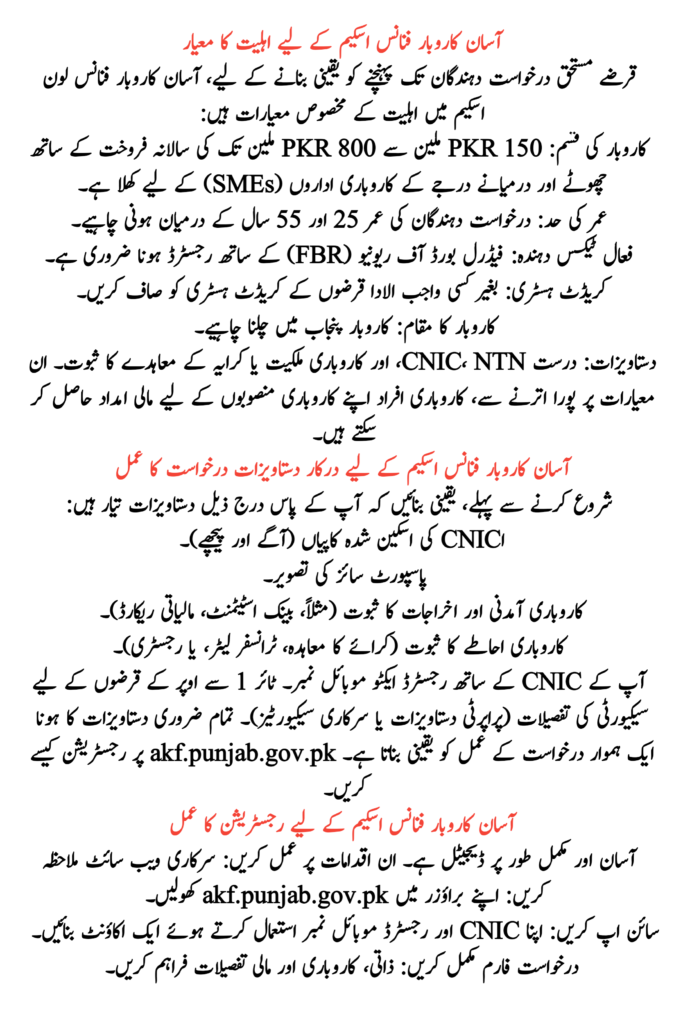

Eligibility Criteria for the Asaan Karobar Finance Scheme

To ensure the loans reach deserving applicants, the Asaan Karobar Finance Loan Scheme has specific eligibility criteria:

- Business Type: Open to small and medium enterprises (SMEs) with annual sales ranging from PKR 150 million to PKR 800 million.

- Age Limit: Applicants must be between 25 and 55 years.

- Active Taxpayer: Must be registered with the Federal Board of Revenue (FBR).

- Credit History: Clean credit history with no overdue loans.

- Business Location: Business must operate within Punjab.

- Documents: Valid CNIC, NTN, and proof of business ownership or rental agreement.

By meeting these criteria, entrepreneurs can secure financial assistance for their business ventures.

Required Documents for the Asaan Karobar Finance Scheme

Before starting the application process, ensure you have the following documents ready:

- Scanned copies of CNIC (front and back).

- A passport-sized photograph.

- Proof of business income and expenses (e.g., bank statements, financial records).

- Proof of business premises (rent agreement, transfer letter, or registry).

- Active mobile number registered with your CNIC.

- Security details for loans above Tier 1 (property documents or government securities).

Having all the necessary documents ensures a smooth application process.

How to Register on akf.punjab.gov.pk

The registration process for the Asaan Karobar Finance Scheme is simple and fully digital. Follow these steps:

- Visit the Official Website: Open akf.punjab.gov.pk in your browser.

- Sign Up: Create an account using your CNIC and a registered mobile number.

- Complete the Application Form: Provide personal, business, and financial details.

- Upload Documents: Attach all required documents in digital format.

- Pay Processing Fee: Non-refundable fee of PKR 5,000 for Tier 1 loans and PKR 10,000 for Tier 2 loans.

- Submit the Form: Review your application for accuracy and submit it.

Once the application is submitted, applicants will receive a confirmation SMS or email.

Loan Disbursement and Repayment Terms

The Asaan Karobar Finance Scheme ensures flexible disbursement and repayment options:

- Disbursement: Approved funds are transferred directly to the applicant’s account.

- Grace Period: Startups receive up to 6 months, while existing businesses have a 3-month grace period.

- Repayment: Equal monthly installments spread over 5 years.

- Late Payment Fee: A nominal charge of PKR 1 per 1,000 rupees per day is applied for overdue payments.

By offering these terms, the scheme encourages responsible financial management while supporting business growth.

Benefits of the Asaan Karobar Finance Loan Scheme

The Asaan Karobar Finance Loan Scheme provides numerous benefits to entrepreneurs:

- Encourages Business Growth: Financial assistance enables businesses to expand operations and explore new opportunities.

- Zero Interest: Reduces financial strain by eliminating interest payments.

- Digital Inclusion: Promotes transparency through online transactions and management.

- Economic Development: Boosts employment opportunities and strengthens Punjab’s economy.

These benefits make the scheme an invaluable resource for entrepreneurs.

Asaan Karobar Finance Helpline Support

For any queries or assistance regarding registration, document submission, or loan disbursement, applicants can contact the Asaan Karobar Finance helpline at 1786. The helpline operates during business hours to provide comprehensive support to entrepreneurs.

Conclusion

The Asaan Karobar Finance Loan Scheme 2025 is a game-changing initiative for Punjab’s entrepreneurs, offering interest-free loans with flexible terms. The program simplifies the process of accessing financial assistance, enabling small and medium businesses to achieve sustainable growth. By registering through akf.punjab.gov.pk, entrepreneurs can unlock the potential of their businesses and contribute to the province’s economic prosperity.

FAQs

1. What is the maximum loan amount available under the scheme?

The scheme offers loans ranging from PKR 1 million to PKR 30 million.

2. How long does it take for loan approval?

Loan approvals typically take 2 to 4 weeks, depending on verification and compliance.

3. Is there a fee for the application process?

Yes, the non-refundable fee is PKR 5,000 for Tier 1 loans and PKR 10,000 for Tier 2 loans.

4. Can startups apply for the loan?

Yes, startups are eligible for the scheme, with a grace period of up to 6 months.

5. How can I check my application status?

You can log in to your account on akf.punjab.gov.pk to track your application status.