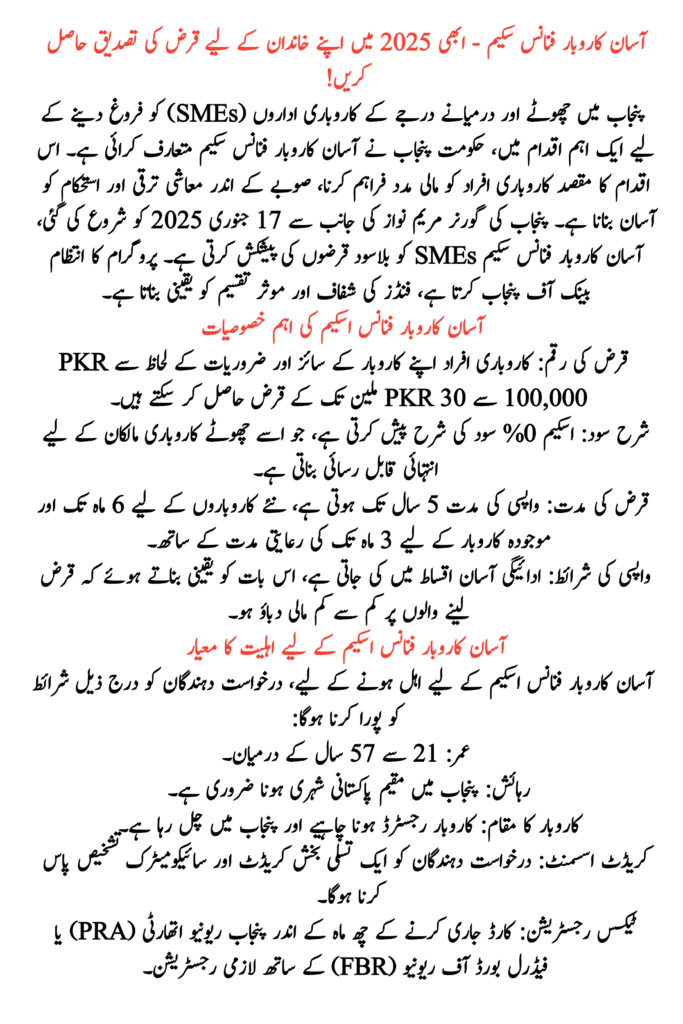

In a significant move to bolster small and medium-sized enterprises (SMEs) in Punjab, the Government of Punjab has introduced the Asan Karobar Finance Scheme. This initiative aims to provide financial assistance to entrepreneurs, facilitating economic growth and stability within the province.

Table of Contents

Launched on January 17, 2025, by Punjab Governor Maryam Nawaz, the Asan Karobar Finance Scheme offers interest-free loans to SMEs. The program is managed by the Bank of Punjab, ensuring transparent and efficient disbursement of funds.

Key Features of the Asan Karobar Finance Scheme

- Loan Amount: Entrepreneurs can avail loans ranging from PKR 100,000 to PKR 30 million, depending on the size and requirements of their business.

- Interest Rate: The scheme offers a 0% interest rate, making it highly accessible for small business owners.

- Loan Tenure: The repayment period extends up to 5 years, with a grace period of up to 6 months for new businesses and up to 3 months for existing businesses.

- Repayment Terms: Repayments are structured in easy installments, ensuring minimal financial strain on the borrowers.

Read More: Payment Method for Asaan Karobar Finance

Key Details

| Feature | Details |

| Launch Date | January 17, 2025 |

| Application Start Date | February 1, 2025 |

| Loan Amount | PKR 100,000 to PKR 30 million |

| Interest Rate | 0% (Interest-Free) |

| Loan Tenure | Up to 5 years |

| Grace Period | 6 months (new businesses), 3 months (existing businesses) |

| Eligibility Age | 21 to 57 years |

| Residency | Must be a Pakistani citizen residing in Punjab |

| Application Fee | PKR 5,000 (Tier 1), PKR 10,000 (Tier 2) (Non-refundable) |

| Cash Withdrawal Limit | Up to 25% of the loan amount |

| Repayment Start Date | After the grace period (from July 2025 onwards) |

| Official Website | akf.punjab.gov.pk |

| Helpline | 1786 |

Eligibility Criteria for the Asan Karobar Finance Scheme

To qualify for the Asan Karobar Finance Scheme, applicants must meet the following conditions:

- Age: Between 21 to 57 years.

- Residency: Must be a Pakistani national residing in Punjab.

- Business Location: The business should be registered and operating within Punjab.

- Credit Assessment: Applicants must pass a satisfactory credit and psychometric evaluation.

- Tax Registration: Mandatory registration with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) within six months of card issuance.

Required Documentation for Asan Karobar Finance Scheme

Applicants need to prepare the following documents:

- CNIC: Valid computerized national identity card.

- Proof of Residence: Utility bills, rent agreement, or domicile verifying Punjab residency.

- Business Registration: Certificate or proof of registered business in Punjab.

- Business Plan: Detailed plan explaining loan utilization and business goals.

- Bank Statements: Past 6 months’ bank transaction history.

- Income Proof: Documentation of existing income or revenue streams.

- Application Form: Completed and signed application.

- Photographs: Recent passport-size photographs.

- Guarantor’s Documents: Guarantor’s CNIC and financial details (if required).

- Tax Documents: National Tax Number (NTN) or proof of tax filing, if applicable.

Read More: Qualify for Asaan Karobar Finance Scheme

Application Process for the Asan Karobar Finance Scheme

- Online Registration: Applicants must sign up on the official portal akf.punjab.gov.pk using a mobile number registered in their name.

- Form Completion: Fill out the application form with accurate personal and business details.

- Document Upload: Upload scanned copies of the required documents.

- Fee Payment: Pay the non-refundable processing fee (PKR 5,000 for Tier 1 and PKR 10,000 for Tier 2).

- Submission: Submit the application and await confirmation via SMS or email.

Asan Karobar Finance Scheme– Get Loan Utilization and Repayment

- Usage: Funds can be used for vendor payments, utility bills, government fees, taxes, and cash withdrawals (up to 25% of the limit) for business purposes.

- Repayment: After a grace period of 3 months, repayments begin with a minimum monthly payment of 5% of the outstanding loan balance. The remaining balance is repaid over 2 years in equal monthly installments.

Contact Information

For further assistance or inquiries

- Helpline: 1786

- Official Website: akf.punjab.gov.pk

Conclusion

The Asan Karobar Finance Scheme is a transformative opportunity for entrepreneurs in Punjab to access interest-free loans, fostering business growth and economic development. Eligible individuals are encouraged to apply and take advantage of this initiative to secure a prosperous future for their families.

Read More: Asaan Karobar Finance Scheme Account Details

FAQs

Who can apply for the Asan Karobar Finance Scheme?

Anyone aged 21 to 57, living in Punjab, and running a registered business can apply.

How much loan can I get?

You can get a loan from PKR 100,000 to PKR 30 million, depending on your business needs.

Is there any interest on this loan?

No, the loan is completely interest-free.

How long do I have to repay the loan?

You can repay it over a period of up to 5 years, with easy monthly installments.

What documents do I need?

You’ll need your CNIC, business registration proof, bank statements, a business plan, and tax registration details.

How do I apply?

You can apply online at akf.punjab.gov.pk by filling out the application form and submitting the required documents.

Is there a grace period before repayment starts?

Yes, new businesses get up to 6 months, and existing businesses get up to 3 months before repayments begin.