The Asaan Karobar Finance Scheme, introduced by the Punjab Government, is a groundbreaking program providing financial assistance to small and medium enterprises (SMEs). With interest-free loans ranging from PKR 1 million to PKR 30 million, the scheme empowers businesses to grow and contribute to economic development. This article highlights the eligibility criteria and guides applicants on how to register.

Table of Contents

Key Features of the Asaan Karobar Finance Scheme

The scheme offers comprehensive financial support, ensuring SMEs have the resources to thrive.

| Feature | Details |

|---|---|

| Loan Amount | PKR 1 million to PKR 30 million |

| Interest Rate | 0% |

| Loan Tenure | Up to 5 years |

| Application Fee | PKR 5,000 to PKR 10,000 (Non-refundable) |

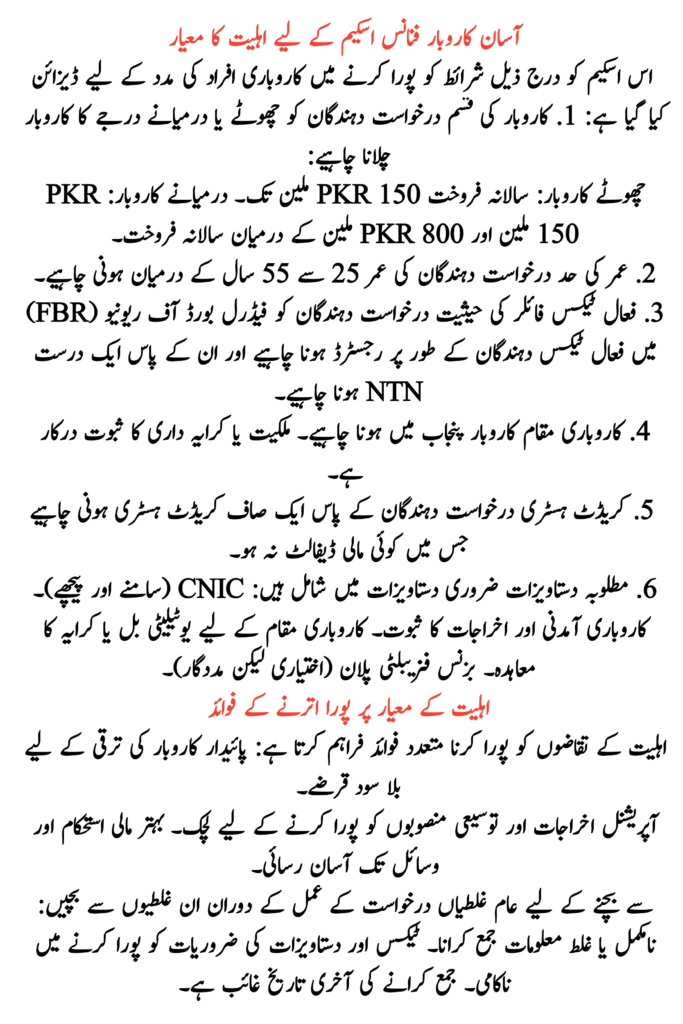

Eligibility Criteria for the Asaan Karobar Finance Scheme

The scheme is designed to assist entrepreneurs meeting the following conditions:

1. Type of Business

Applicants must operate a small or medium-sized enterprise:

- Small businesses: Annual sales up to PKR 150 million.

- Medium businesses: Annual sales between PKR 150 million and PKR 800 million.

2. Age Limit

Applicants should be between 25 and 55 years old.

3. Active Tax Filer Status

Applicants must be registered as active taxpayers with the Federal Board of Revenue (FBR) and possess a valid NTN.

4. Business Location

The business must be situated in Punjab. Proof of ownership or tenancy is required.

5. Credit History

Applicants must have a clean credit history with no financial defaults.

6. Documents Required

Essential documents include:

- CNIC (Front and Back).

- Proof of business income and expenses.

- Utility bills or rent agreement for the business location.

- Business feasibility plan (optional but helpful).

Benefits of Meeting the Eligibility Criteria

Meeting the eligibility requirements provides numerous benefits:

- Interest-free loans for sustainable business growth.

- Flexibility to cover operational costs and expansion plans.

- Improved financial stability and easier access to resources.

Common Mistakes to Avoid

Avoid these errors during the application process:

- Submitting incomplete or incorrect information.

- Failing to meet tax and documentation requirements.

- Missing submission deadlines.

How to Apply for the Asaan Karobar Finance Scheme

Follow these steps to register for the scheme:

- Visit the Official Portal: Open akf.punjab.gov.pk.

- Create an Account: Register using your CNIC and a valid mobile number.

- Fill Out the Application Form: Enter accurate business and personal details.

- Upload Required Documents: Attach all relevant documents in scanned form.

- Pay the Application Fee: PKR 5,000 for smaller loans or PKR 10,000 for larger loans.

- Submit Your Application: Ensure all information is correct before submitting.

Once approved, the loan amount will be disbursed through the Bank of Punjab.

Helpline for Assistance

For any queries regarding the Asaan Karobar Finance Scheme, applicants can contact the dedicated helpline at 1786. This service provides guidance on registration, document submission, eligibility criteria, and any other concerns related to the program.

Conclusion

The Asaan Karobar Finance Scheme is a remarkable initiative supporting SMEs in Punjab with interest-free loans and financial sustainability. By adhering to the eligibility criteria and applying correctly, businesses can secure funding to achieve growth and success.

For more details and to register, visit the official website: akf.punjab.gov.pk.

FAQs

1. What is the maximum loan amount under the scheme?

The maximum loan amount is PKR 30 million.

2. Are startups eligible for the scheme?

Yes, startups can apply if they meet the criteria and provide a solid business plan.

3. What documents are mandatory for application?

Applicants must submit CNIC, proof of business income and expenses, utility bills or rent agreement, and a feasibility plan.

4. Is there a grace period for repayment?

Yes, startups receive a six-month grace period, while existing businesses get three months.

5. Can I reapply if my application is rejected?

Yes, after resolving the issues that led to rejection, you can reapply.