Starting a small business in Punjab has become more accessible with the introduction of the Asaan Karobar Finance Scheme 2025. This initiative offers interest-free loans to empower Small and Medium Enterprises (SMEs) in the province, aiming to drive economic growth by supporting entrepreneurship, job creation, and exports.

Read More: Get the CM Punjab Asaan Karobar Finance Loan

The Asaan Karobar Finance Scheme provides interest-free loans to SMEs in Punjab. The loans are designed to support new businesses, expansion of existing ones, modernization efforts, and working capital needs.

Key Features:

- Loan Amount: Up to PKR 30 million.

- Repayment Period: Easy monthly installments over five years.

- Eligibility: Residents of Punjab aged 21 to 57 years with a valid CNIC and registered mobile number. Applicants must be tax filers with a clean credit history.

Table of Contents

Table: Key Details

| Feature | Asaan Karobar Finance Scheme | Asaan Karobar Card |

| Loan Amount | Up to PKR 30 million | Up to PKR 1 million |

| Repayment Period | 5 years | 3 years |

| Eligibility Age | 21 to 57 years | 25 to 55 years |

| Eligibility Criteria | Valid CNIC, registered mobile number, tax filer, clean credit history | Valid CNIC, registered mobile number, tax filer, non-defaulter |

| Application Portal | akf.punjab.gov.pk | akc.punjab.gov.pk |

| Helpline | 1786 | 1786 |

Steps to Start Your Small Business in Punjab through Asaan Karobar Finance

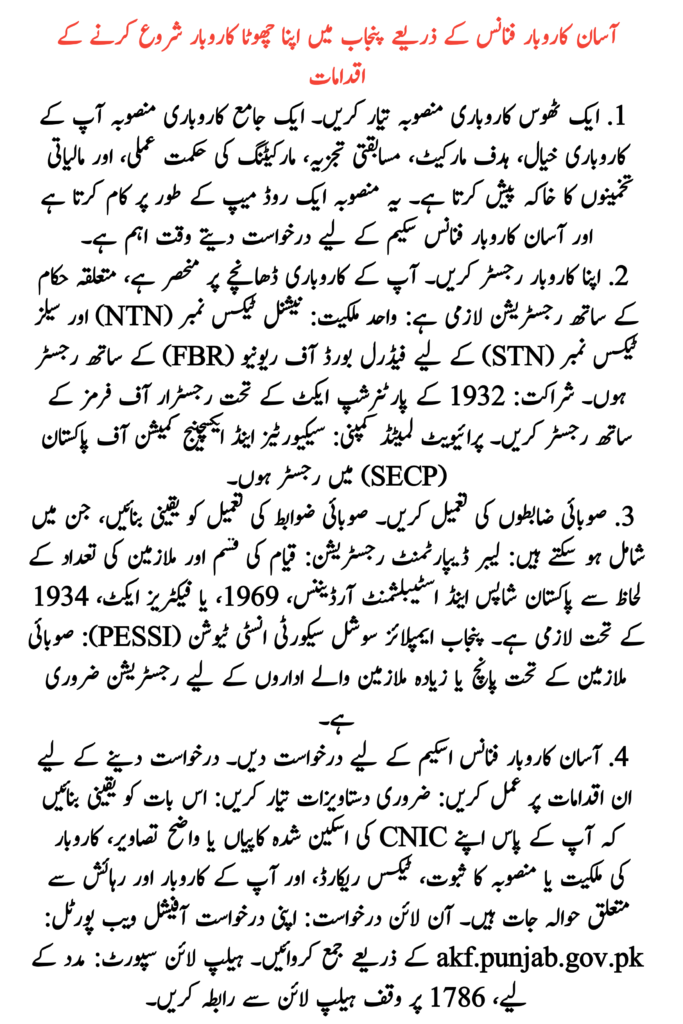

1. Develop a Solid Business Plan

- A comprehensive business plan outlines your business idea, target market, competitive analysis, marketing strategy, and financial projections. This plan serves as a roadmap and is crucial when applying for the Asaan Karobar Finance Scheme.

Read More: Asaan Karobar Finance Scheme Online Apply Rules

2. Register Your Business

Depending on your business structure, registration with relevant authorities is mandatory:

- Sole Proprietorship: Register with the Federal Board of Revenue (FBR) for a National Tax Number (NTN) and Sales Tax Number (STN).

- Partnership: Register with the Registrar of Firms under The Partnership Act of 1932.

- Private Limited Company: Register with the Securities and Exchange Commission of Pakistan (SECP).

3. Comply with Provincial Regulations

Ensure compliance with provincial regulations, which may include:

- Labour Department Registration: Mandatory under the Pakistan Shops and Establishment Ordinance, 1969, or Factories Act, 1934, depending on the type of establishment and number of employees.

- Punjab Employees Social Security Institution (PESSI): Registration is required for establishments with five or more employees under the Provincial Employees.

4. Apply for the Asaan Karobar Finance Scheme

Follow these steps to apply:

- Prepare Necessary Documents: Ensure you have scanned copies or clear images of your CNIC, proof of business ownership or plan, tax records, and references related to your business and residence.

- Online Application: Submit your application through the official web portal: akf.punjab.gov.pk.

- Helpline Support: For assistance, contact the dedicated helpline at 1786.

5. Leverage the Asaan Karobar Card

The Asaan Karobar Card offers interest-free loans up to PKR 1 million for startups and small businesses. It facilitates payments for raw materials, government fees, taxes, and utility bills. Up to 25% of the loan amount can be withdrawn as cash.

Key Features:

- Loan Amount: Up to PKR 1 million.

- Repayment Period: Easy monthly installments over three years.

- Eligibility: Residents of Punjab aged 25 to 55 years, including men, women, transgender, and special persons. Applicants must be active tax filers and not defaulters of any financial institution.

Read More: Applying for the Asan Karobar Finance Scheme

Conclusion

Embarking on a small business venture in Punjab is now more attainable with the Asaan Karobar Finance Scheme 2025. By developing a solid business plan, ensuring proper registration and compliance, and utilizing the financial support available, aspiring entrepreneurs can contribute to the province’s economic growth and achieve their business aspirations.

Read More: Eligibility Criteria for the Asaan Karobar Finance Scheme